An angel investor is an individual who invests capital into a business for equity ownership, mainly share capital. The main goal of investment is to make a return as they progress the production of products and services that sustain humanity and the environment. There are about 400,000 angel investors in the U.S. who invest about $30 billion in 60,000 startups every year.

Diaspora University Town (DUT) is at a point where it can welcome angel investors.

Diaspora Kenyans and Kenyans are invited herein to establish themselves to become Angel Investors in DUT – MSMEs (Micro, Small and Medium Enterprises).

Diaspora University Town (DUT) first angel investment plan is a $50 million plan.

The $50 million will be put into 16 MSMEs through 250,000 investments of $200/Ksh 25,000.

The $50 million will grow to about $500 million by year 5 and is projected to receive dividends of about $10 million from year 6 onward.

| CAPITAL INPUT | CAPITAL VALUATION |

|||||

|---|---|---|---|---|---|---|

| Company | Ksh | $50M | $50M Value | Total Value | ||

| 1 | Daktari Biotechnology Co. | 1,500,000,000 | $12,000,000 | $90,000,000 | $300,000,000 | Read More |

| 2 | DUT Credit Ltd. | 1,050,000,000 | $8,400,000 | $84,000,000 | $240,000,000 | Read More |

| 3 | DUT Design-Build Co. | 500,000,000 | $4,000,000 | $60,000,000 | $240,000,000 | Read More |

| 4 | DUT Tourism Hotel | 500,000,000 | $4,000,000 | $40,000,000 | $50,000,000 | Read More |

| 5 | Cars & Vehicles Co | 500,000,000 | $4,000,000 | $46,000,000 | $46,000,000 | Read More |

| 6 | Buildings Materials Co. | 250,000,000 | $2,000,000 | $20,000,000 | $80,000,000 | Read More |

| 7 | Med Supplies & Equip Co. | 250,000,000 | $2,000,000 | $20,000,000 | $40,000,000 | Read More |

| 8 | Jamhuri Diaspora Media | 250,000,000 | $2,000,000 | $20,000,000 | $40,000,000 | Read More |

| 9 | Vehicle Disposal & Repairs | 250,000,000 | $2,000,000 | $20,000,000 | $20,000,000 | Read More |

| 10 | Laundry Mart Co. | 250,000,000 | $2,000,000 | $20,000,000 | $20,000,000 | Read More |

| 11 | Sports, & Gym Co. | 250,000,000 | $2,000,000 | $20,000,000 | $20,000,000 | Read More |

| 12 | DUT Clothing Co. | 200,000,000 | $1,600,000 | $20,000,000 | $20,000,000 | Read More |

| 13 | DUT ICT Systems Co. | 125,000,000 | $1,000,000 | $10,000,000 | $20,000,000 | Read More |

| 14 | DUT ICT Products Co. | 125,000,000 | $1,000,000 | $10,000,000 | $20,000,000 | Read More |

| 15 | Dental Clinic | 125,000,000 | $1,000,000 | $10,000,000 | $20,000,000 | Read More |

| 16 | Office Supplies Co. | 125,000,000 | $1,000,000 | $10,000,000 | $10,000,000 | Read More |

| $50,000,000 | $500,000,000 | $1,186,000,000 | ||||

The $50 million will grow to about $500 million. The 16 Companies' total valuation at the end of 5 years will be about $1,186 billion.

Website: dktb.co.ke

introduction

Daktari Biotechnology Ltd is a company founded by Scientists, Diaspora University Trust, Diaspora Kenyans, and Kenyans to advance the quality of healthcare through medicines and vaccines production and progressing to be established at Diaspora University Town. The company will produce medicine as well as open pharmacies in the town. The company will also work closely with Diaspora University and the Diaspora University Medical Hospital.

Dr. WILSON ENDEGE FOUNDER'S MESSAGE

I’m a Diaspora Kenyan who has lived and worked in the pharmaceutical sector in academia at Harvard University and at Chiron Diagnostics Inc., Millennium Pharmaceuticals Inc., and AstraZeneca Pharmaceuticals.

Joined by five scientists, we are progressing the founding of Daktari Biotechnology Ltd. Three are Diaspora Kenyans, as follows: Dr. Patrick Shompole of Pullman, WA; Dr. Benson Edagwa of Omaha, NE; and Dr. Bernard Ayanga of Houston, TX.

We wish to welcome Diaspora Kenyans and Kenyans who are or would like to become Founding Angel Investors to join us in creating a company that I’m determined to grow in value to reach $300 million as we expand the Kenya and Africa market for medicines and vaccines through Kenya and Africa GDP growth.

Fifty of the biggest pharmaceutical industries have a market capitalization ranging from $15 billion to $580 billion, with a total valuation of $4.7 trillion. Join us, and let’s develop Daktari Biotechnology Company to grow to a market valuation of $1 billion (Ksh 120 billion) in 10 years.

$12 MILLION FOUNDER ANGEL INVESTMENT

1. 60,000 investment units of $200 (Ksh 25,000).

2. There is no limit to the number of investment units an angel investor can take.

$12 MILLION USAGE

1. $8 million will be applied to Plant Construction & Equipment Installation

2. $3.2 million will be applied in Human & Animal Medicines & Vaccines Research & Manufacturing.

3. $800,000 will be applied toward opening of pharmacies.

ASSETS, CAPITAL, LOANS PLAN

| Asset | DUT, Scientists & Investors | FAI’s $12 M | Retained Profits | Loans from DUT Credit | Total |

|---|---|---|---|---|---|

| Land (4 Plots) | $700,000 | – | – | – | $700,000 |

| Company Set-Up | $600,000 | – | – | – | $600,000 |

| Technologies | $3,000,000 | – | – | – | $3,000,000 |

| Plant Building & Equipment | $1,200,000 | $8,000,000 | $30,000,000 | $10,000,000 | $49,200,000 |

| Research | $1,500,000 | $2,000,000 | – | – | $3,500,000 |

| Stocks / Cash | – | $1,000,000 | $10,000,000 | $10,000,000 | $21,000,000 |

| Pharmacies | – | $1,000,000 | $5,420,000 | $10,000,000 | $16,420,000 |

| Totals | $7,000,000 | $12,000,000 | $45,420,000 | $30,000,000 | $94,420,000 |

JOBS, PHARMACIES, PRODUCT PRODUCTION, REVENUE, EXPENSES, PROFITS & DIVIDENDS

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

|---|---|---|---|---|---|

| Jobs | 20 | 100 | 200 | 400 | 1,000 |

| Pharmacies | 3 | 10 | 30 | 60 | 100 |

| Product Production | — | — | 1,000,000 | 10,000,000 | 100,000,000 |

| Revenue ($) | $500,000 | $1,000,000 | $10,000,000 | $40,000,000 | $200,000,000 |

| Expenses | $300,000 | $600,000 | $6,000,000 | $24,000,000 | $120,000,000 |

| Gross Profit | $200,000 | $400,000 | $4,000,000 | $16,000,000 | $80,000,000 |

| Tax | $60,000 | $120,000 | $1,200,000 | $4,800,000 | $24,000,000 |

| Net Profit | $140,000 | $280,000 | $2,800,000 | $11,200,000 | $56,000,000 |

| Retained | $140,000 | $280,000 | $2,800,000 | $6,200,000 | $36,000,000 |

| Dividend | — | — | — | $5,000,000 | $20,000,000 |

| Dividend/Share | — | — | — | $0.5 | $2 |

BALANCE SHEET (ASSETS = LIABILITIES + SHARE CAPITAL)

| Assets | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

|---|---|---|---|---|---|

| Stocks/Cash/Other | $8,240,000 | $9,420,000 | $15,220,000 | $19,420,000 | $28,100,000 |

| Property/Equipment | $14,900,000 | $18,000,000 | $24,000,000 | $28,000,000 | $49,900,000 |

| Pharmacies | $1,000,000 | $2,000,000 | $8,000,000 | $11,000,000 | $16,420,000 |

| TOTAL | $24,140,000 | $29,420,000 | $47,220,000 | $58,420,000 | $94,420,000 |

| Liabilities & Capital | |||||

| Loans | $5,000,000 | $10,000,000 | $25,000,000 | $30,000,000 | $30,000,000 |

| Share Capital | $19,000,000 | $19,000,000 | $19,000,000 | $19,000,000 | $19,000,000 |

| Retained Profits | $140,000 | $420,000 | $3,220,000 | $9,420,000 | $45,420,000 |

| TOTAL | $24,140,000 | $29,420,000 | $47,220,000 | $58,420,000 | $94,420,000 |

NOTES

1. As the company achieves sales of $200 million and a net profit of $56 million from the sales the company valuation will be about $300 million.

2. The $12 million (3 Million shares) or 30% would in year 5 be valued at $90 million.

Website: dutcredit.co.ke

introduction

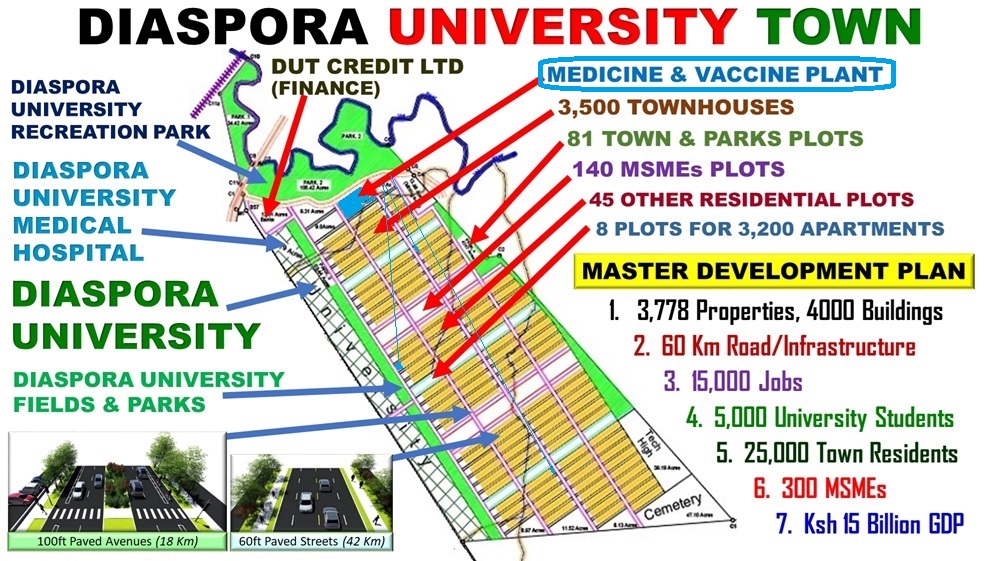

DUT Credit Ltd. is a financial services company founded in 2020 by Diaspora University Trust, Diaspora Kenyans, and Ndara B Community members to advance the growth of banking assets through job creation and making land resources productive.

The company is allocated a three-acre plot at DUT where it will build its property as well as offices for rental.

DAN KAMAU – EXECUTIVE TRUSTEE & DUT CREDIT LTD FOUNDING DIRECTOR MESSAGE

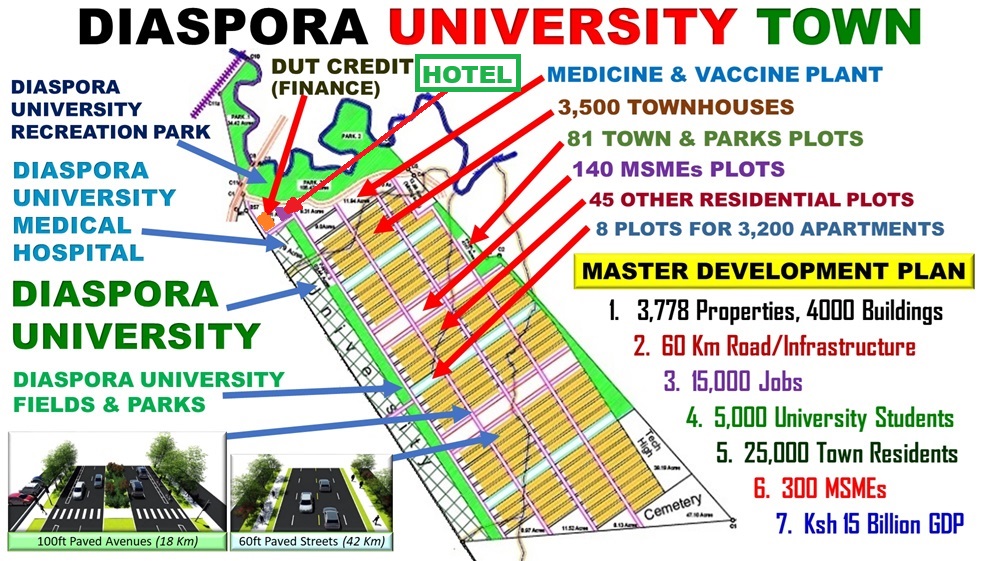

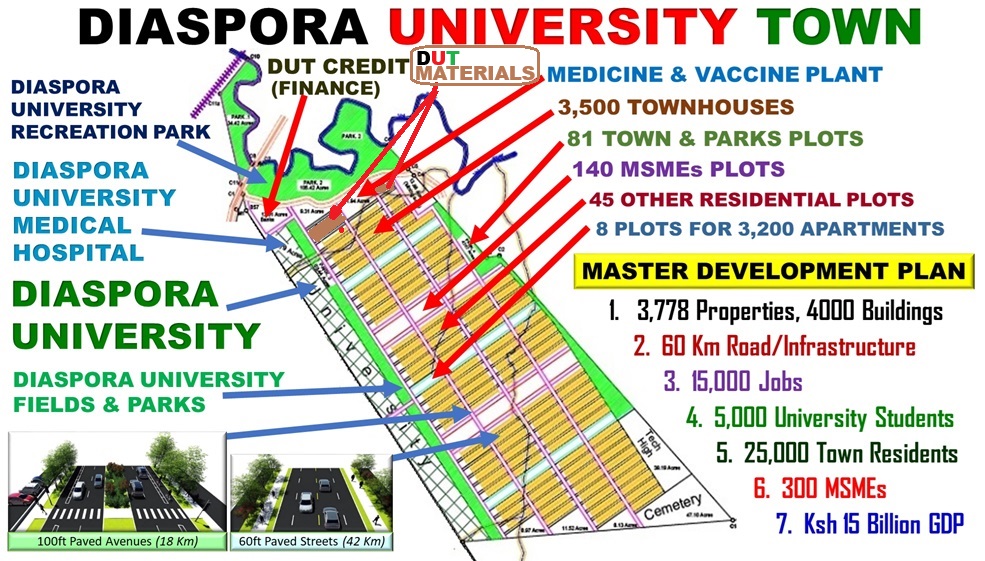

The Diaspora University Town (DUT) Master Development Plan (MDP) established an opportunity to open a financial institution.

DUT Credit Ltd was opened in 2020 by Diaspora Kenyans, Ndara B Community members, and the Diaspora University Trust. The company has an opportunity for an $8.4 million investment for angel investors.

$8.4 MILLION ANGEL INVESTMENT

1. 60,000 investment units of $200 (Ksh 25,000).

2. There is no limit to the number of investment units an angel investor can take.

PURPOSE

1. $1.4 million to build a property on a 3-acre plot at DUT.

2. The $7 million to issue a construction loan to DUT.

LOANS

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

|---|---|---|---|---|---|

| Construction | $10,000,000 | $15,000,000 | $15,000,000 | $15,000,000 | $15,000,000 |

| Mortgages | $40,000,000 | $100,000,000 | $180,000,000 | $250,000,000 | $300,000,000 |

| MSMEs | $8,000,000 | $30,000,000 | $55,000,000 | $70,000,000 | $115,000,000 |

| Individual | $2,000,000 | $5,000,000 | $10,000,000 | $15,000,000 | $20,000,000 |

| Total Loan | $60,000,000 | $150,000,000 | $260,000,000 | $350,000,000 | $450,000,000 |

PROFIT/LOSS

| Revenue | $12,000,000 | $30,000,000 | $52,000,000 | $70,000,000 | $90,000,000 |

| Less | |||||

| Loan/Dep Interest | $3,000,000 | $8,000,000 | $13,500,000 | $17,500,000 | $21,500,000 |

| Operation Expenses | $2,400,000 | $6,000,000 | $10,400,000 | $14,000,000 | $18,000,000 |

| Gross Profit | $6,600,000 | $16,000,000 | $28,100,000 | $38,500,000 | $50,500,000 |

| Tax | $1,980,000 | $4,800,000 | $8,430,000 | $11,550,000 | $15,150,000 |

| Net Profit | $4,620,000 | $11,200,000 | $19,670,000 | $26,950,000 | $35,350,000 |

BALANCE SHEET

| Assets | |||||

| Cash | $12,000,000 | $32,000,000 | $54,000,000 | $70,000,000 | $86,000,000 |

| Loan Advances | $60,000,000 | $150,000,000 | $260,000,000 | $350,000,000 | $450,000,000 |

| Other Assets | $7,820,000 | $14,020,000 | $16,690,000 | $18,640,000 | $19,990,000 |

| Total Assets | $79,820,000 | $196,020,000 | $330,690,000 | $438,640,000 | $555,990,000 |

| Liabilities | |||||

|---|---|---|---|---|---|

| Loans/Deposits | $60,000,000 | $160,000,000 | $270,000,000 | $350,000,000 | $430,000,000 |

| Other Liabilities | $5,000,000 | $10,000,000 | $15,000,000 | $16,000,000 | $18,000,000 |

| Total Liabilities | $65,000,000 | $170,000,000 | $285,000,000 | $366,000,000 | $448,000,000 |

| Share Capital | |||||

| Issued + Premium | $10,200,000 | $10,200,000 | $10,200,000 | $10,200,000 | $10,200,000 |

| Retained Profits | $4,620,000 | $15,820,000 | $35,490,000 | $62,440,000 | $97,790,000 |

| Total Share Capital | $14,820,000 | $26,020,000 | $45,690,000 | $72,640,000 | $107,990,000 |

| Grand Total | $79,820,000 | $196,020,000 | $330,690,000 | $438,640,000 | $555,990,000 |

NOTES

1. Deposits will grow based on the following plans: Diaspora University Endowment plan of $20 billion; the $50 million Diaspora Angels Founders plan, the DUT property plan, 20,000 jobs, 100 million hours of human resource productivity plan, and other plans.

2. DUT credit will source loans at low rates as part of its loan/deposit plan.

3. The net profits in the first 5 years will be retained to grow the share capital.

4. The financial institution would be listed on the stock exchange after 5 years.

5. The company would be worth about $240 million in the market.

6. The $8.4 million invested by Angel Investors would be worth about $84 million.

introduction

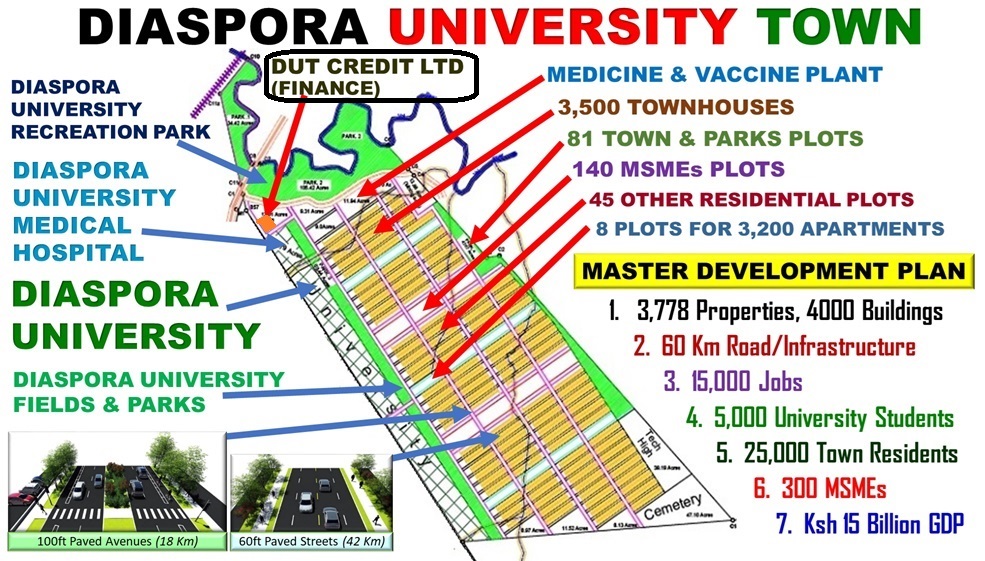

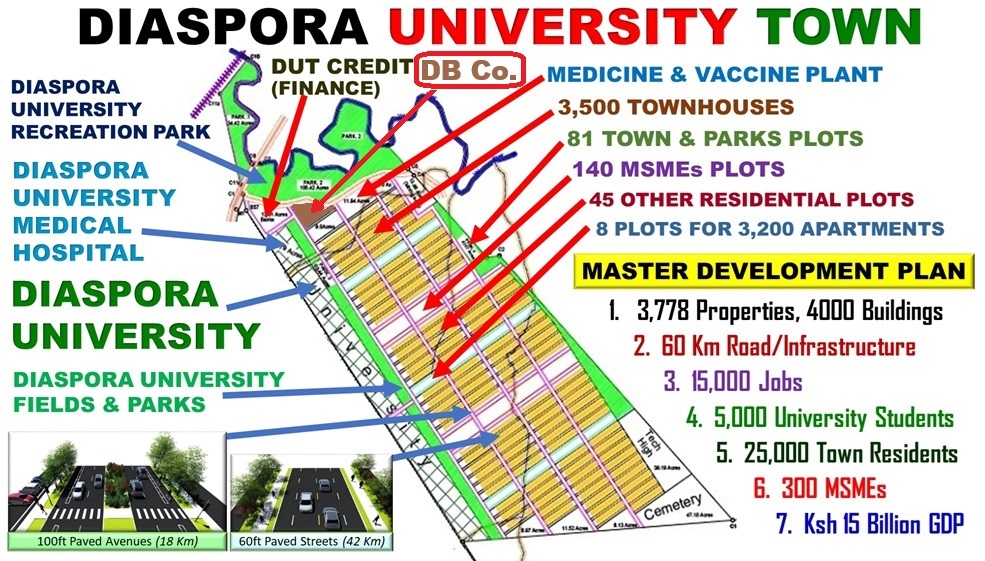

DUT Design Build Company is a construction company. The company is allocated a 9-acre plot at DUT. It will build its property and operate from this location.

The company will design and build the Diaspora University Town and execute the construction work. The estimated budget is $316 million (Ksh 39.5 billion).

The company's goal is to grow and become a top design-build company in Kenya and Africa. The top 20 design-build companies in the U.S. had construction revenues ranging from $1.4 billion to $8.2 billion, totaling $61 billion.

The DUT DB Company's target is to reach a yearly revenue of $1 billion by the 10th year as it constructs new towns, buildings, roads, dams, and other infrastructure in Kenya and Africa. To achieve this goal, the company will work closely with the Diaspora University School of Engineering and the Projects-Based Learning Center.

Founders

The founders are:

1. Diaspora University Trust

2. Eng. Jack Njaramba

3. Architect David Ogoli

4. Architect Rose Dama

5. Barnabas Mwadembo – Constructor

6. Other Professionals.

$4 MILLION FOUNDER ANGEL INVESTMENT

1. 40,000 investment units of $200 (Ksh 25,000).

2. There is no limit to the number of investment units an angel investor can take.

PURPOSE

1. $2 million building construction and equipment.

2. $2 million cash for starting contracts.

ASSETS, CAPITAL, LOANS PLAN

| ASSETS PLAN | DUT & Founders | FAI's $4 Million | Retained Profits | Loans from DUT Credit | Total |

|---|---|---|---|---|---|

| Land (1 Plots) | $500,000 | $500,000 | |||

| Systems and Plans | $9,500,000 | $9,500,000 | |||

| Building/Equip | $2,000,000 | $40,000,000 | $40,000,000 | $82,000,000 | |

| Cash/Current Assets | $2,000,000 | $20,300,000 | $22,300,000 | ||

| Total | $10,000,000 | $4,000,000 | $60,300,000 | $40,000,000 | $114,300,000 |

PROFIT/LOSS

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

|---|---|---|---|---|---|

| Jobs | 2,000 | 3,000 | 4,000 | 5,000 | 10,000 |

| Projects | 1 | 1 | 2 | 4 | 10 |

| Revenue ($) | $50,000,000 | $100,000,000 | $150,000,000 | $200,000,000 | $300,000,000 |

| Expenses | $47,000,000 | $90,000,000 | $124,000,000 | $160,000,000 | $250,000,000 |

| Gross Profit | $3,000,000 | $10,000,000 | $26,000,000 | $40,000,000 | $50,000,000 |

| Tax | $900,000 | $3,000,000 | $7,800,000 | $12,000,000 | $15,000,000 |

| Net Profit | $2,100,000 | $7,000,000 | $18,200,000 | $28,000,000 | $35,000,000 |

| Retained | $2,100,000 | $7,000,000 | $18,200,000 | $18,000,000 | $15,000,000 |

| Dividend | $10,000,000 | 20,000,000 | |||

| Dividend/Share | $5 | $10 | |||

BALANCE SHEET (ASSETS = LIABILITIES + SHARE CAPITAL)

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

|---|---|---|---|---|---|

| Assets | |||||

| Stocks/Cash/Other | $13,100,000 | $19,100,000 | $28,300,000 | $35,300,000 | $42,300,000 |

| Property/Equipment | $6,000,000 | $12,000,000 | $25,000,000 | $44,000,000 | $72,000,000 |

| TOTAL | $19,100,000 | $31,100,000 | $53,300,000 | $79,300,000 | $114,300,000 |

| Liabilities & Capital | |||||

| Loans | $3,000,000 | $8,000,000 | $12,000,000 | $20,000,000 | $40,000,000 |

| Share Capital | $14,000,000 | $14,000,000 | $14,000,000 | $14,000,000 | $14,000,000 |

| Retained Profits | $2,100,000 | $9,100,000 | $27,300,000 | $45,300,000 | $60,300,000 |

| TOTAL | $19,100,000 | $31,100,000 | $53,300,000 | $79,300,000 | $114,300,000 |

NOTES

1. As the company's revenue grows to $300 million (37.5 billion) through construction work at about 10 different sites, and a net profit of $35 million is achieved, the company's valuation will grow to about $240 million.

2. The $4 million (500,000 shares) or 25% would, in year 5, be valued at about $60 million.

introduction

DUT Tourism Hotel Company is a company whose establishment is progressing both in the U.S and in Kenya. The company's two main plans are to develop a 500-room hotel and to achieve a 1 million tourist plan for Diaspora University Town. The tourists will be accommodated at the hotel.

The hotel will be built on a 3-acre plot that is adjacent to the Diaspora University Recreation and Water Park. The 139-acre park, which will be designed and constructed similarly to theme and water parks around the world, will have at least 1,000 visitors a day. The hotel will be the main residential place for the visitors.

Founders

The founders are:

1. Diaspora University Trust

2. Frank Mutura – Hotel

3. Cathy Jackie Mutahi - Tourism

The founder’s goal is to achieve a hotel of 500 rooms at DUT and other hotels in Kenya.

The second goal is to achieve a tourism plan of 1 million tourists to Diaspora University Town (DUT).

$4 MILLION FOUNDER ANGEL INVESTMENT

1. 40,000 investment units of $200 (Ksh 25,000).

2. There is no limit to the number of investment units an angel investor can take.

PURPOSE

1. $3.5 million property building, equipment and furniture.

2. $500,000 million starting cash capital

ASSETS, CAPITAL, LOANS PLAN

| ASSETS PLAN | DUT & Founders | FAI's $4 Million | Retained Profits | Loans from DUT Credit | Total |

|---|---|---|---|---|---|

| Land (2 Plots) | $200,000 | $200,000 | |||

| Systems and Plans | $400,000 | $400,000 | |||

| Building/Equip | $3,500,000 | 20,000,000 | $30,000,000 | $53,500,000 | |

| Cash/Current Assets | $500,000 | 13,664,000 | $14,164,000 | ||

| Total | $600,000 | $4,000,000 | $33,664,000 | $30,000,000 | $68,264,000 |

JOBS, TOURISTS, HOTELS, PROFITS AND DIVIDENDS

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

|---|---|---|---|---|---|

| Jobs | 10 | 50 | 100 | 300 | 500 |

| Tourists | 1,000 | 50,000 | 200,000 | 500,000 | 1,000,000 |

| Hotels | 1 | 2 | 3 | 5 | |

| Revenue ($) | $100,000 | $5,000,000 | $20,000,000 | $50,000,000 | $100,000,000 |

| Expenses | $80,000 | $3,500,000 | $12,000,000 | $30,000,000 | $60,000,000 |

| Gross Profit | $20,000 | $1,500,000 | $8,000,000 | $20,000,000 | $40,000,000 |

| Tax | $6,000 | $450,000 | $2,400,000 | $6,000,000 | $12,000,000 |

| Net Profit | $14,000 | $1,050,000 | $5,600,000 | $14,000,000 | $28,000,000 |

| Retained | $14,000 | $1,050,000 | $5,600,000 | $9,000,000 | $18,000,000 |

| Dividend | $5,000,000 | 10,000,000 | |||

| Dividend/Share | $5 | $10 | |||

BALANCE SHEET (ASSETS = LIABILITIES + SHARE CAPITAL)

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

|---|---|---|---|---|---|

| Assets | |||||

| Stocks/Cash/Other | $1,114,000 | $1,664,000 | $6,264,000 | $10,264,000 | $14,564,000 |

| Property/Equipment | $4,500,000 | $8,000,000 | $12,000,000 | $25,000,000 | $53,700,000 |

| TOTAL | $5,614,000 | $9,664,000 | $18,264,000 | $35,264,000 | $68,264,000 |

| Liabilities & Capital | |||||

| Loans | $1,000,000 | $4,000,000 | $7,000,000 | $15,000,000 | $30,000,000 |

| Share Capital | $4,600,000 | $4,600,000 | $4,600,000 | $4,600,000 | $4,600,000 |

| Retained Profits | $14,000 | $1,064,000 | $6,664,000 | $15,664,000 | $33,664,000 |

| TOTAL | $5,614,000 | $9,664,000 | $18,264,000 | $35,264,000 | $68,264,000 |

NOTES

1. As the company revenues grows to $100 million (Ksh 12.5 billion) through the 1 million tourism and hotel plan and the net profit of $28 million; the company valuation will be grow to about $50 million.

2. The $4 million (800,000 shares) or 80% would in year 5 will be valued at $40 million.

introduction

DUT Building Materials Company is progressing toward being established at the Diaspora University Town (DUT).

The company’s plan of producing materials that will be applied in the DUT $316 million Design-Build budget has started.

The company's plan is to supply materials worth about $15 million from this budget.

The company's material management services will earn $3 million from the $316 million budget.

The company is allocated two plots at DUT and has access to all areas of DUT that it wishes to utilize for production and management services.

The company's long-term goal is to achieve $1 billion in sales in 10 years as it produces building materials across Kenya and sells building materials through retail outlets throughout Kenya.

The company will work closely with the DUT Design-Build Company, Diaspora University, and DUT Credit Ltd to achieve this goal.

Founders

The founders are:

1. Diaspora University Trust

2. Ronald Mwangombe – Building Materials Production

3. Jackson Kimanzi – Building Materials Supply

$2 MILLION FOUNDER ANGEL INVESTMENT

1. 20,000 investment units of $200 (Ksh 25,000).

2. There is no limit to the number of investment units an angel investor can take.

PURPOSE

1. $1.5 million Building and equipment.

2. $500,000 million stocks/cash capital

ASSETS, CAPITAL, LOANS PLAN

| ASSETS PLAN | DUT & Founders | FAI's $2 Million | Retained Profits | Loans from DUT Credit | Total |

|---|---|---|---|---|---|

| Land (2 Plots) | $400,000 | $400,000 | |||

| Systems and Plans | $100,000 | $100,000 | |||

| Building/Equipment | $1,500,000 | $1,500,000 | $50,000,000 | $73,000,000 | |

| Cash/Current Assets | $300,000 | $500,000 | $26,430,000 | $27,230,000 | |

| Total | $800,000 | $2,000,000 | $47,930,000 | $50,000,000 | $100,730,000 |

JOBS, PROFITS AND DIVIDENDS

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

|---|---|---|---|---|---|

| Jobs | 100 | 500 | 1,000 | 2,000 | 5,000 |

| Revenue ($) | $1,000,000 | $4,000,000 | $20,000,000 | $50,000,000 | $150,000,000 |

| Expenses | $700,000 | $2,400,000 | $12,000,000 | $30,000,000 | $90,000,000 |

| Gross Profit | $300,000 | $1,600,000 | $8,000,000 | $20,000,000 | $60,000,000 |

| Tax | $90,000 | $480,000 | $2,400,000 | $6,000,000 | $18,000,000 |

| Net Profit | $210,000 | $1,120,000 | $5,600,000 | $14,000,000 | $42,000,000 |

| Retained | $210,000 | $1,120,000 | $5,600,000 | $9,000,000 | $32,000,000 |

| Dividend | $5,000,000 | $10,000,000 | |||

| Dividend/Share | $5 | $10 |

BALANCE SHEET (ASSETS = LIABILITIES + SHARE CAPITAL)

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

|---|---|---|---|---|---|

| Assets | |||||

| Stocks/Cash/Other | $510,000 | $1,130,000 | $7,730,000 | $13,730,000 | $27,730,000 |

| Property/Equipment | $3,500,000 | $8,000,000 | $12,000,000 | $25,000,000 | $73,000,000 |

| TOTAL | $4,010,000 | $9,130,000 | $19,730,000 | $38,730,000 | $100,730,000 |

| Liabilities & Capital | |||||

| Loans | $1,000,000 | $5,000,000 | $10,000,000 | $20,000,000 | $50,000,000 |

| Share Capital | $2,800,000 | $2,800,000 | $2,800,000 | $2,800,000 | $2,800,000 |

| Retained Profits | $210,000 | $1,330,000 | $6,930,000 | $15,930,000 | $47,930,000 |

| TOTAL | $4,010,000 | $9,130,000 | $19,730,000 | $38,730,000 | $100,730,000 |

NOTES

1. As the company revenue grows to $150 million (Ksh 18 billion) and the net profit reaches $42 million, the company's valuation will grow to about $80 million.

2. The $2 million (250,000 shares) or 25% would, in year 5, be valued at $20 million.

Need Help? Chat with us